Reading time: 1 minute

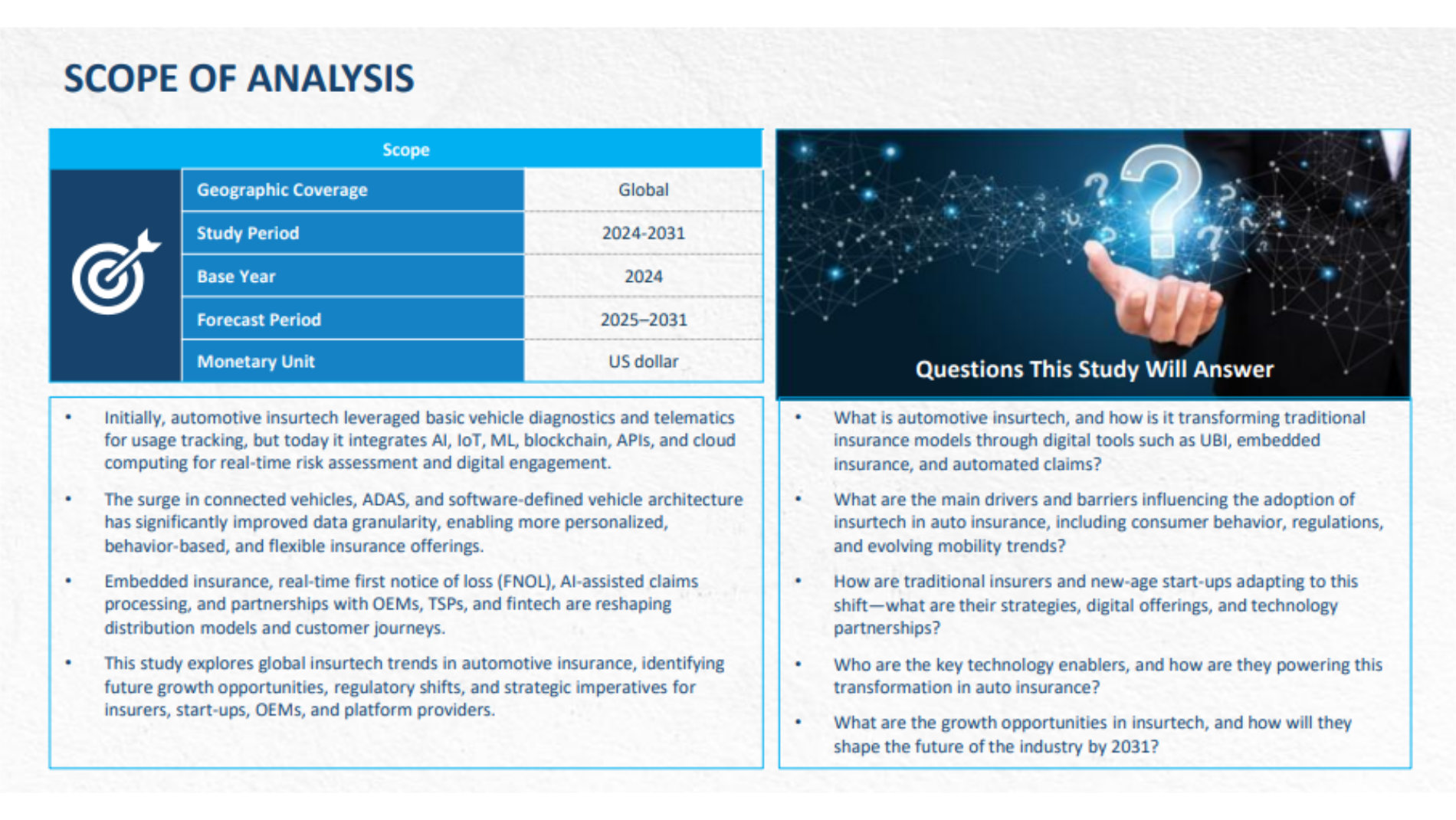

Traditional insurance models relied on fixed risk categories and demographic factors. Today, connected vehicles and software-defined architectures enable real-time assessment of driving behavior, paving the way for flexible models such as pay-how-you-drive and pay-as-you-go. Insurance is increasingly becoming embedded directly at the point of vehicle sale, while AI-powered claims processing and automated First Notice of Loss (FNOL) systems are redefining customer experience.

Changing mobility trends — including the rise of electric vehicles, car-sharing, and subscription models — are creating demand for modular and on-demand insurance products. These innovations open new opportunities in data analytics, fraud prevention, blockchain-based smart contracts, and real-time customer engagement. Frost & Sullivan forecasts that by 2030, more than 200 million vehicles worldwide will be equipped with usage-based insurance (UBI) features.

However, challenges remain. Data privacy concerns, fragmented global regulations, and low consumer awareness continue to slow adoption. Success in this new era will depend on transparency, strong technology partnerships with OEMs, and a customer-first approach.

The result is an increasingly connected, automated, and intelligent insurance ecosystem — one that rewards safer driving, accelerates claims handling, and sets new standards for safety and user experience across the automotive sector

Read the full Frost & Sullivan study here to gain a detailed insight.